It’s been four years since I began my journey into customer success.

In that time, I’ve seen both disastrous and very successful applications of customer success surveys.

Every bad example has been a cautionary tale in itself, with new ways in which the customer feedback survey would fail or bring no value whatsoever.

However, all successful applications of these surveys have something in common - follow-through and gusto.

Today, I’ll talk about the steps you need to replicate their wins and improve your customer success process with customer success surveys.

Exploring Customer Success Surveys

What is customer success?

I’ve defined my area of expertise more times than I can remember, and it always comes down to this:

Customer success is a business practice that centers around ensuring customers’ goals, needs, and successes. It makes sure they’re not only achieved but enabled by and improved through your product and your customer success team’s efforts.

While it’s a specific mantra for customer success teams and the tools they use, it’s also a mindset that puts your growth as a business in a directly proportional relationship to the number of milestones your customers reach and surpass.

What kind of surveys work for customer success?

There are many possible surveys throughout a customer’s journey - from brand awareness to market research and many others. I’ll focus on three survey types most closely related to customer success:

- Customer satisfaction surveys (CSAT). While they can vary in size, shape, and placement, CSAT surveys always try to find out how satisfied a customer is with the company’s products, services, support, and other touchpoints.

- Product feedback surveys. They are a subclass of CSATs that have to do exclusively with product feedback. While they’re generally lumped together with customer satisfaction surveys, we in customer success like to treat product feedback surveys separately just because of the insane value they can bring.

- NPS® surveys. Net Promoter Score surveys are designed for you to find out how inclined your customers are to promote your business/product/services. It ties directly into customer satisfaction and success, though its consistent overuse and poor placement have lessened its effectiveness and decreased average answer rates. Don’t worry - I’ll have some pro tips to counteract that too.

How to Improve Customer Success with Customer Surveys

Your goal should be to use your survey results to improve customer success. And one thing you should never forget is to stay focused on that goal. Write it on a note and stick it to the side of your screen if you have to. Nine times out of 10 people lose sight of their initial purpose for a survey - make sure you’re not one of them.

1. Aim for the ideal placement

Potentially, the most critical decision about your survey is where you place it, and it tends to have the most impact on answer rates out of all factors.

There are several placements that work here. I’ll start with the one that can bring the most value to customer success:

Contextual micro-surveys

By placing a feedback form right next to specific product features, you’re opening yourself up to direct customer feedback for those features. You can even place a small NPS microsurvey in the same spot asking users how likely they are to recommend that feature to a friend or colleague.

These badges can be tailored to appear at custom times and for select users, displaying based on usage stats, success rates, etc. A good survey software will let you target specific sets of visitors based on your ideal set of attributes (page visits, action taken, user type).

This is a tactic I often recommend for unique features that make products stand out. Here’s an example of an in-product survey from Semrush that’s well-placed, subtle, and easy to fill out:

Automated messages via preferred channels

Most customer success tools and customer support tools now have the option to determine the preferred channel of communication for an account. While message type and customer age influence the initial reach out, subsequent reach-outs should go out where the customer has been the most responsive or where they have messaged you.

Below is an example of a message with a link survey automated to go out several days after a customer started using a beta version of the product. Notice it’s short, to the point, and sent via their preferred channel:

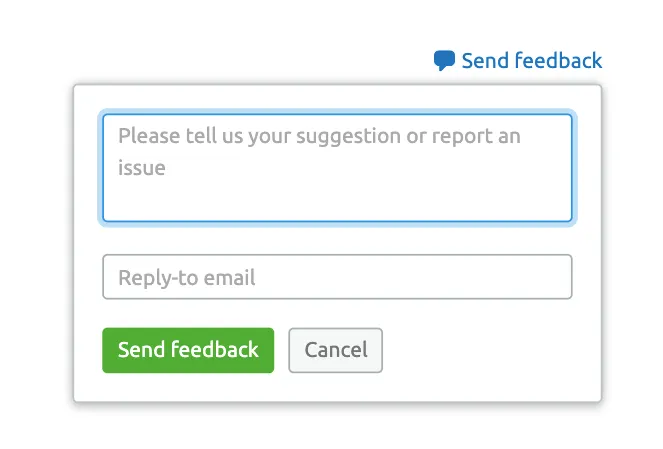

Buttons or icons

The last option means simply placing feedback buttons and icons inside your product so your users can leave their opinions or answer NPS questions whenever they like. These are better for overall customer satisfaction surveys about the entire product, service, or support quality.

2. Make sure enough people take the survey

One mistake I often see throughout the SaaS space consists of surveys that don’t collect enough relevant data to make accurate conclusions or warrant related product changes. Think of it like this:

Say a SaaS rolls out a new feature. They send out a survey to see how their customers like it. The problem is - they only have ten customers, as the company is still very small. If nine out of them say they don’t like a feature - it might seem worrying. But consider the same scenario with 1000 customers with only nine saying they dislike the feature - everything’s changed.

The fewer customers and survey respondents you have, the more statistically irrelevant your results are. For smaller groups of respondents, it’s better l to run an open question survey.

Another mistake that leads to the same problem is when startups send surveys too early in the product lifecycle. Early adopters always have unique perspectives, but you shouldn’t draw premature conclusions as they might not represent your target audience accurately for various reasons (e.g., your early adopters are just friends and business relations).

3. Find the right stage of the customer journey

Customers in different stages want to be spoken to in different ways. You can’t approach a customer during onboarding as you would a customer you’ve known for years.

You should use the same idea for customer surveys. Plus, you’ll always have different questions based on the different stages in the customer journey. Here are three stage-specific surveys that have a great impact on customer success:

- Onboarding surveys. During the early stages of a customer’s relationship with your company, you’ll want to know things like: did they learn the product quickly, are they having issues with specific tasks, do they want tutorials on how to do complex things, etc. A properly run onboarding survey can be a gold mine for customer success teams.

- Session exit surveys. Typically considered more of a placement choice, exit surveys are more about the stage in the customer journey when you engage the customer. Exit surveys always go out during the retention or loyalty stages and are placed after a tracker clocks that a user completed a task they set out to do. As such, exit surveys should be worded to appeal to retained/loyal customers - with kindness and consideration for the longstanding relationship you have. And they should always be short, easy to complete. This is why many exit surveys have basic NPS or CSAT questions. While that’s a safe option, you might want to try something different to stand out and increase answer rates, e.g., “What would you change to complete this task faster?” as a multiple-choice question.

- Offboarding surveys. Another frequent mistake I’ve seen is when CSMs don’t reach out to churned clients. Let’s refer to an example - Referrizer, a client of ours, set up an offboarding process that involved a survey. They posed it during one-on-one offboarding interviews, and the result was 25% of the customers that churned during the height of the pandemic came back. Using customer success data and insights from the first few interviews, they developed a script for future offboarding interviews. In future offboarding surveys, they were ready with counteroffers, discounts, and other proposals that would help their customers during the challenging beginning of the pandemic.

All three of the above can significantly improve customer retention and promote loyalty.

4. Find the right question

When writing the actual questions, you’re going to face a few critical decisions:

- Closed question or open question? A lot of arguments can be presented for both options, but open questions tend to offer more insights for customer success teams. Closed questions can be good for quick, short surveys - especially if you have a large customer base.

- Formal or casual tone-of-voice? This will depend on your type of business, your audience, and your rapport with the customer(s) taking the survey.

- What type of closed question? If you pick closed questions, you’ll have many to choose from. Check out these survey templates to get inspired.

- Closed question with the open option? Using rating scales for a closed question and then asking people to give more details as a separate question is a good way to go. The only downside is you’re adding an extra question and thus increasing the time it will take to complete the survey.

5. Don’t corrupt the data set

For how often they happen, corrupt data sets are surprisingly easy to keep away from. It’s a simple matter of following some basic, common-sense rules:

- Don’t change the questions during the survey period.

- Don’t change the answers during the survey period.

- Don’t make sampling errors or change the sampling methods during the survey.

- Don’t add biased questions.

- Don’t add questions that are too complex for your audience.

- Don’t use highly-subjective words (feel, believe, think, interesting, dangerous, etc.).

- Don’t reply to the survey yourself, and make sure your team doesn’t either.

Consider researching more specialized advice on survey errors that will corrupt your data.

How to Act Upon Customer Success Survey Feedback

There’s plenty of work-for-work’s sake in business, and SaaS is no exception. Plenty of businesses do things just because they’re industry standards or best practices - including customer success surveys.

This means that the people in charge run surveys, get the results, read and interpret data, and maybe go on a 1.5-hour Zoom call to discuss them. More often than not, things end here.

Without the focus on obtaining valuable insights and product feedback, surveys are worse than useless - they are a drain on resources. Two things are mandatory for customer surveys to achieve success:

- Product improvements according to user feedback from customer surveys (website, marketing, support, service quality improvements, and more also fit in this category)

- Aid for marketing materials based on the success of the customer feedback process. Cross-promotional efforts are always a great look for any business, and they have a lot of power to convince your leads

Here are some examples of people who’ve used customer feedback successfully:

Changing the product according to customer feedback

Here’s a very simple example of implementing customer feedback into the product.

"We offer virtual team-building activities as a service. Our default platform is Zoom, and one of the most common feedback tips we heard from clients is they wanted to do events on Microsoft Teams, Google Meet, and Webex too.

So, we developed additional event types that can be run on any platform. These events are designed to focus on the group dynamics more than the technology itself.

As a result, we’ve seen customer satisfaction scores increase and also growth in revenue. I would estimate we win 15 - 20% more deals because of the flexibility offered in platforms. And this growth is a direct result of listening to customer feedback."

Michael Alexis, CEO of TeamBuilding

Changing the business to satisfy and delight the customers

If you let customer feedback influence all of your business decisions, you’re bound to succeed. Here’s an example of a customer success approach from a non-SaaS organization:

"Customer feedback has always been the reason behind the continuous improvement of the products and services that I offer in my fitness business. I no longer rely on our meetings and brainstorming sessions to spot which areas of the business need to improve.

You must also not forget to include your customers in the loop about the changes you’ll be making. This way they’ll know that their voices were heard and that you value them. And if you manage to forge a clear dialogue with them, they can be the biggest growth driver for your business."

Brian Bram, Founder/CEO of Home Gym Strength

Fueling marketing with customer feedback

After successfully implementing feedback, the next step is using customer insights for marketing:

"Customer feedback was an important part of our marketing overhaul in the past few years. As a SaaS company, we have to build our products to match our customers' needs, and over the years, we had a lot of different feedback about our products.

Our most successful approach with customer feedback was to use negative reviews we got in the past to present our modern product as an upgraded, perfected version. We highlighted each and every improvement we made and used it as a marketing advantage. We also launched a customer service hero campaign on our social media profiles, where we highlighted various positive stories from our customer service agents. We showed our customers that we care about their feedback and use it to actively improve our products for their pleasure."

Andriy Shvets, CMO of MacKeeper

Survey Your Way to Success

These simple steps can be the difference between your surveys being a waste of time and a boon on your customer success efforts. The choice is up to you - will you follow through with your process and act on survey replies?

Let me know what the overall experience with surveys is for you and your customer success team! I’m always eager to hear fresh perspectives and experiments from CSMs from all industries and backgrounds.

Join Survicate's community and harness the power of customer feedback insights. Get started with our 10-day trial and access essential features by signing up and reviewing our pricing for flexible subscription options.